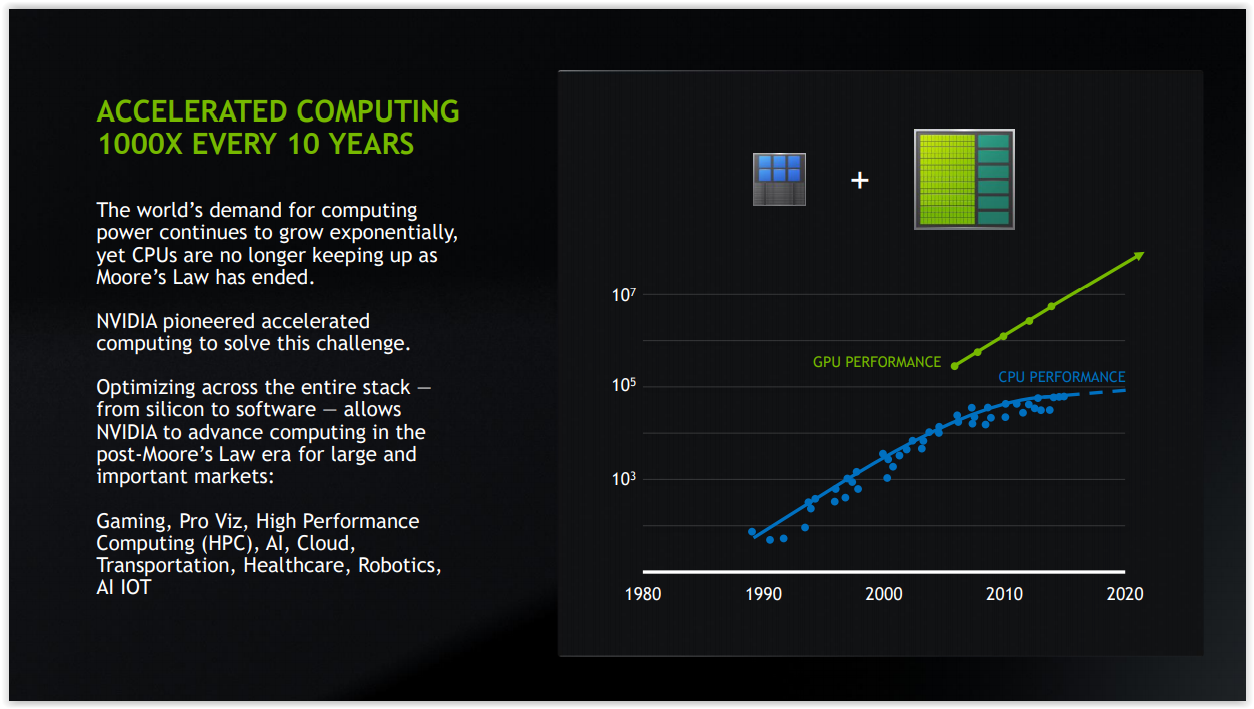

Nvidia also scored poorly on other metrics like operating earnings yield and free cash flow yield. That's particularly embarrassing considering the grades are relative to the Information Technology sector which provides it with low bars to clear.įor instance, the Information Technology sector has a median dividend yield of 1.2 percent, as compared with the Materials sector's 1.7 percent.

The resulting puny dividend yield unsurprisingly caused Nvidia to get an F grade in Seeking Alpha's Dividend Scorecard. ( GME) despite the latter's over 4,700 percent appreciation over the past year. Similarly, Nvidia's market cap is more than 30 times higher than another meme stock GameStop Corp. ( AMC) by market cap, and that's after the latter's over 2,500 percent year-to-date gain. This means Nvidia is 16.7 times larger than AMC Entertainment Holdings, Inc. Its market capitalization is around $500 billion. This is especially because Nvidia Corporation is not a small-cap company. The huge jump in share price in just over a month has some calling it a " crowded trade". Since my commentary Nvidia: Highly Anticipated Stock Split Is A Shot In The Armwas published on May 24, NVDA stock has climbed over 30 percent. If you are a retiree, banking entirely on Nvidia's dividends to get by, you would need to own loads and loads of NVDA shares to avoid going hungry. One would need to own 50 shares worth around $40,000 to collect enough dividend to buy a Big Breakfast meal from McDonald's ( MCD) in New York, every three months.

Pretty much chump change for small investors. To put it simply, after footing around $800 to buy one share of NVDA before the ex-dividend date on 9 June 2021, you as a shareholder will be receiving $0.16 on 1 July 2021. This is way lower than its long-term average of 0.75 percent. However, thanks to its share price spurt, you may be forgiven for thinking NVDA does not pay any dividend, as the dividend yield has shrunk to a mere 0.08 percent. Nvidia Corporation ( NASDAQ: NVDA) pays a non-trivial $0.16 dividend per quarter, amounting to $0.64 per year. 10-Q True false SeptemFALSE 2020 Q3 RNWK RealNetworks, Inc.

0 kommentar(er)

0 kommentar(er)